Would You Let $80 Hold You Back from Buying a Home in Tampa Bay?

Would You Let $80 a Month Hold You Back from Buying a Home in Tampa Bay?

Tampa Bay homebuyers are closer to affordability than they think. Here’s why waiting for rates to hit the 5s might not save you much—and could actually cost you more in the long run.

A lot of homebuyers are in “wait and see” mode right now. They’re watching mortgage rates hover a little above 6% and thinking, “I’ll buy once they hit the 5s.” But here’s the reality: that magic 5.99% number might not save you as much as you think.

Affordability is still a challenge—but Tampa Bay buyers already have a head start. Mortgage rates have dropped from their peak earlier this year, quietly saving today’s buyers hundreds each month.

How Much You’ve Already Saved Without Realizing It

Back in May, rates peaked above 7%. Since then, they’ve slowly eased into the low 6s. It doesn’t sound like a huge difference—until you do the math.

According to Redfin, the typical monthly payment on a $400,000 home is already down nearly $400 since May. That’s real savings for Tampa Bay buyers who thought homeownership was out of reach earlier this year.

And while it may be tempting to wait for that perfect 5.99% rate, that small difference could actually cost you more overall.

Where Experts Say Mortgage Rates Are Headed

Most economists expect mortgage rates to hold near current levels through 2026. The Mortgage Bankers Association projects only mild declines, and Fannie Mae is the lone major forecaster predicting rates could dip into the high 5s next year:

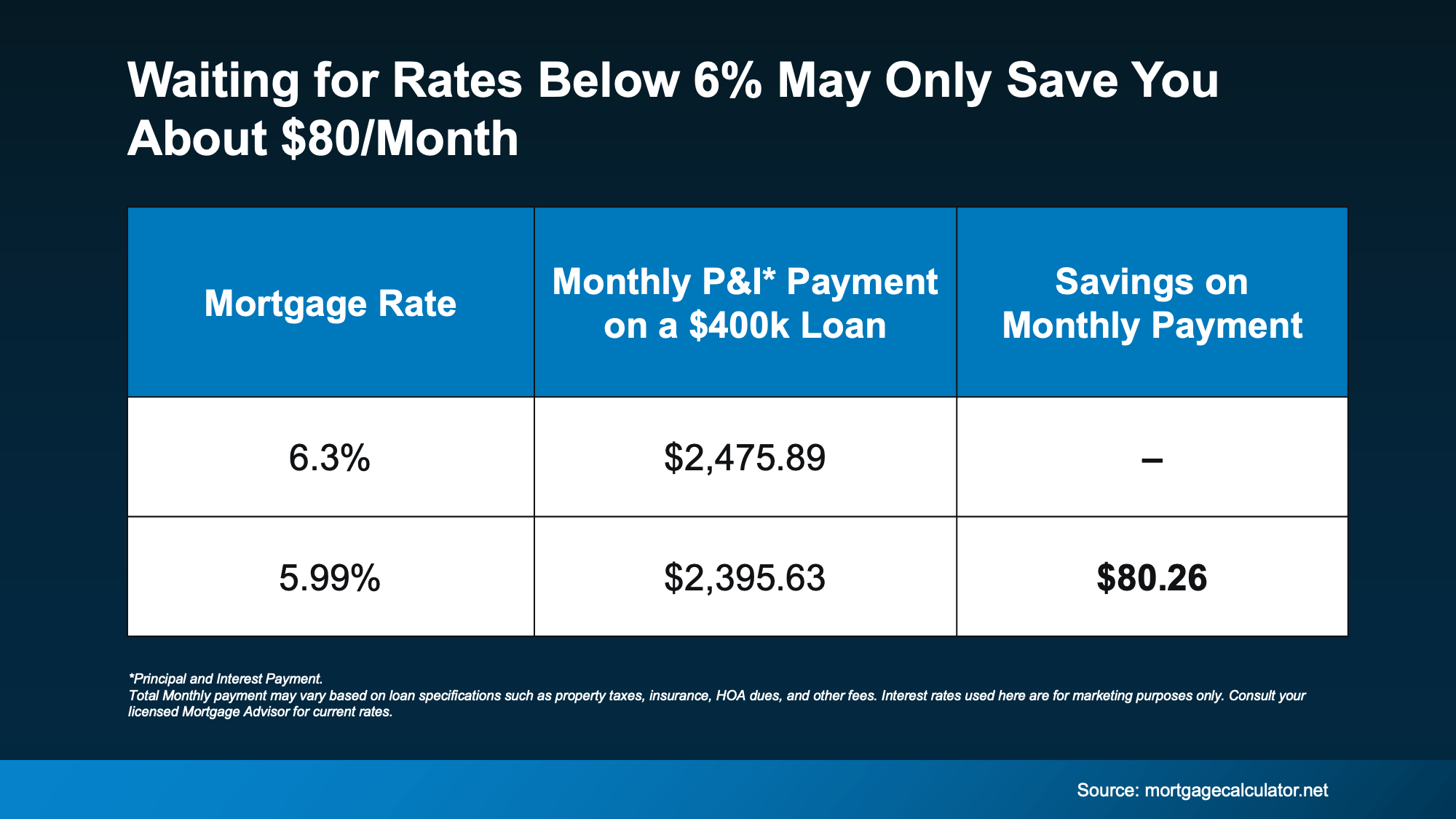

The Real Math Behind 5.99%

Dropping from 6.2% to 5.99% may sound significant, but in reality, it’s a difference of roughly $80 a month on an average $400,000 home. That’s about one dinner out—or a week’s worth of coffee runs.

Meanwhile, today’s buyers have already captured nearly $400 in monthly savings since spring. So the real question becomes: Is $80 really worth waiting for?

When Rates Fall, Competition Rises

Right now, Tampa Bay buyers have options: more listings, motivated sellers, and room to negotiate. But once rates dip below 6%, the market will shift fast.

The National Association of Realtors reports that if rates hit 6%, roughly 5.5 million more households could suddenly afford to buy. Even if just a fraction of them re-enter the market, competition will heat up—and prices will likely follow.

That extra $80 you’re waiting to save could disappear in higher home prices and bidding wars.

Quick FAQs for Tampa Bay Buyers

- Are mortgage rates expected to fall below 6%?

- Maybe—but not by much. Most experts forecast rates to stay between 6% and 6.25% through 2026.

- Is now a good time to buy in Tampa Bay?

- Yes—inventory is up, sellers are motivated, and competition is lower before rates dip again.

- How much can I save by buying now?

- Compared to May 2025, Tampa Bay buyers are already saving nearly $400 a month on average payments.

Bottom Line

You don’t have to wait for 5.99%. The savings are already here. If you find a home you love in Carrollwood, Citrus Park, Westchase, South Tampa, or anywhere in Hillsborough County, make your move now while the market’s still calm.

Let’s connect and run your numbers so you can see exactly what today’s rates mean for your monthly payment—and your future wealth.

Related Tampa Bay Mortgage Insights

Categories

- All Blogs (29)

- Builder Incentives (1)

- Buyer Advice (4)

- First-Time Homebuyers (5)

- Florida Real Estate (1)

- Hillsborough County Real Estate (8)

- Home Buying & Selling Tips (16)

- Home Buying Tips (3)

- Housing Prices & Market Updates (14)

- Local Communities (1)

- Local Market Insights (14)

- Market Forecasts & Predictions (12)

- Market Trends (13)

- Mortgage & Financing (11)

- Move-In-Ready Homes (1)

- New Construction (1)

- Real Estate Market Trends (6)

- Seller Advice (2)

- Tampa Real Estate (12)

- Tampa Real Estate Market (5)

Recent Posts

Realtor® / Civil Engineer | License ID: FL# 3626016 CA# 02201474

+1(813) 729-2053 | soukaina.aroui@exprealty.com