Don’t Fear Today’s Mortgage Rates — Why Acting Now Can Pay Off in Tampa Bay

Why You Don’t Need To Be Afraid of Today’s Mortgage Rates

Mortgage rates have been the “monster under the bed” for many Tampa Bay buyers. But waiting for that perfect 5-point-something number could end up costing you more than you think.

Every time mortgage rates tick up, buyers flinch and say, “Maybe I’ll wait.” But here’s the twist—waiting for that magical 5-point-something rate could end up haunting your wallet later.

The Magic Number

According to the National Association of Realtors (NAR) , a 30-year fixed rate of 6% would make the median-priced home affordable for roughly 5.5 million more households—including 1.6 million renters.

“If rates were to hit that magic number, about 10%—or 550,000—of those additional households would likely buy a home within the next 12–18 months.”

When rates reach that sweet spot, as expert forecasters predict could happen in 2026, pent-up demand will surge—and that activity will push prices higher.

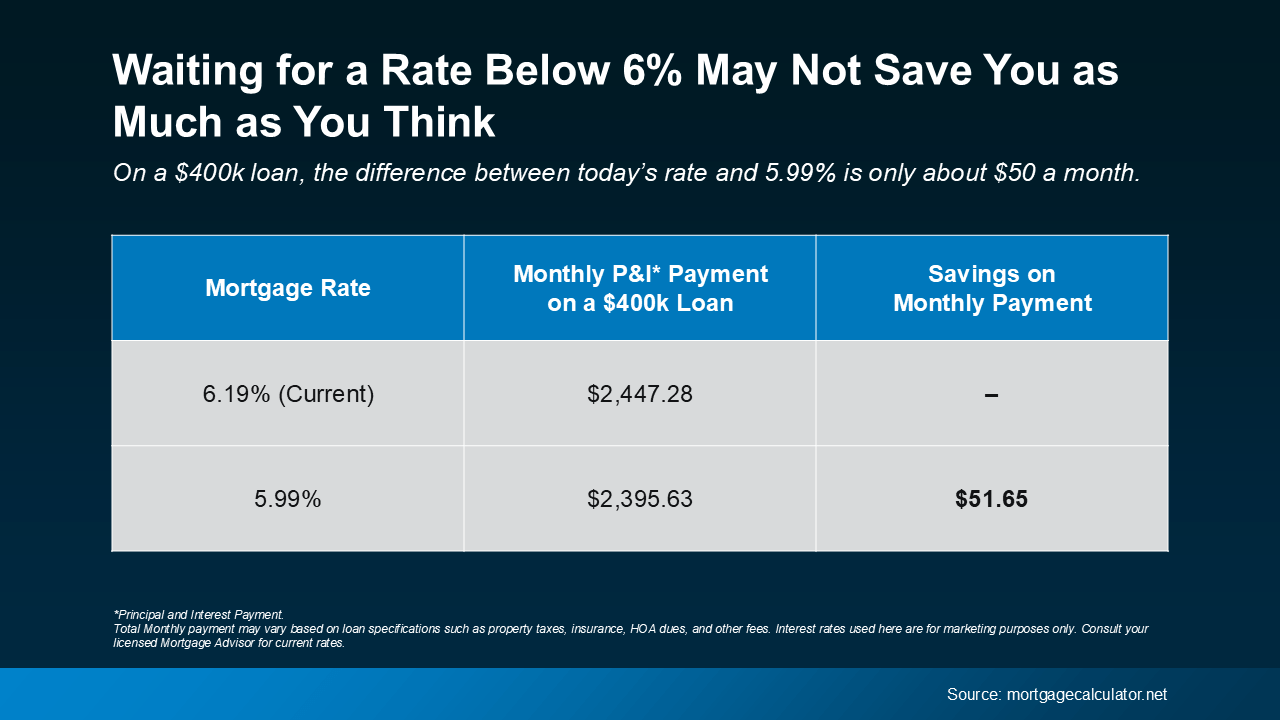

While a 5.99% rate might sound like a win, the savings may be smaller than expected. On a $400,000 loan, the difference between 6.2% and 5.99% is roughly $50 a month—less than many spend on weekly coffee runs. As prices rise, that difference could disappear fast.

By waiting, you could miss out on today’s advantages—more homes to choose from, stronger negotiating power, and fewer competing buyers. Once rates dip below 6%, competition and prices will climb again.

Why Acting Now Makes Sense

Jessica Lautz, Deputy Chief Economist at NAR, notes:

“Over the last five weeks, mortgage rates have averaged 6.31%. This has provided savvy buyers a sweet spot to re-examine the home-search process with more inventory and wider choices.”

Similarly, Matt Vernon, Head of Retail Lending at Bank of America, explains:

“Rather than waiting it out for a rate they like better, homebuyers should assess their financial situation—if the house is right and the payments are affordable, it could be the right chance to make a move.”

Bottom Line

If buying at today’s rate makes you nervous, remember—waiting doesn’t always pay off. Once rates fall below 6%, more buyers (and higher prices) will return.

Don’t be afraid of today’s mortgage rates. If you’re ready, this might be your chance to make your move before the market wakes up again.

More Tampa Bay Market Insights

Categories

- All Blogs (29)

- Builder Incentives (1)

- Buyer Advice (4)

- First-Time Homebuyers (5)

- Florida Real Estate (1)

- Hillsborough County Real Estate (8)

- Home Buying & Selling Tips (16)

- Home Buying Tips (3)

- Housing Prices & Market Updates (14)

- Local Communities (1)

- Local Market Insights (14)

- Market Forecasts & Predictions (12)

- Market Trends (13)

- Mortgage & Financing (11)

- Move-In-Ready Homes (1)

- New Construction (1)

- Real Estate Market Trends (6)

- Seller Advice (2)

- Tampa Real Estate (12)

- Tampa Real Estate Market (5)

Recent Posts

Realtor® / Civil Engineer | License ID: FL# 3626016 CA# 02201474

+1(813) 729-2053 | soukaina.aroui@exprealty.com