Housing Market Is Turning a Corner Going into 2026 | Tampa Bay Update

The Housing Market Is Turning a Corner Going into 2026

Tampa Bay’s housing market is gaining real momentum heading into 2026. Here’s what buyers and sellers in Carrollwood, Citrus Park, Westchase, and South Tampa need to know.

After several years of high mortgage rates and slowed buyer activity, momentum is finally building beneath the surface of the housing market. Sellers are reappearing. Buyers are re-engaging. And for the first time in a long while, real movement is happening again in Tampa Bay.

It’s not a surge — but it is a meaningful shift. And it’s setting the stage for a more balanced, more active 2026. Here are the three biggest trends driving the comeback.

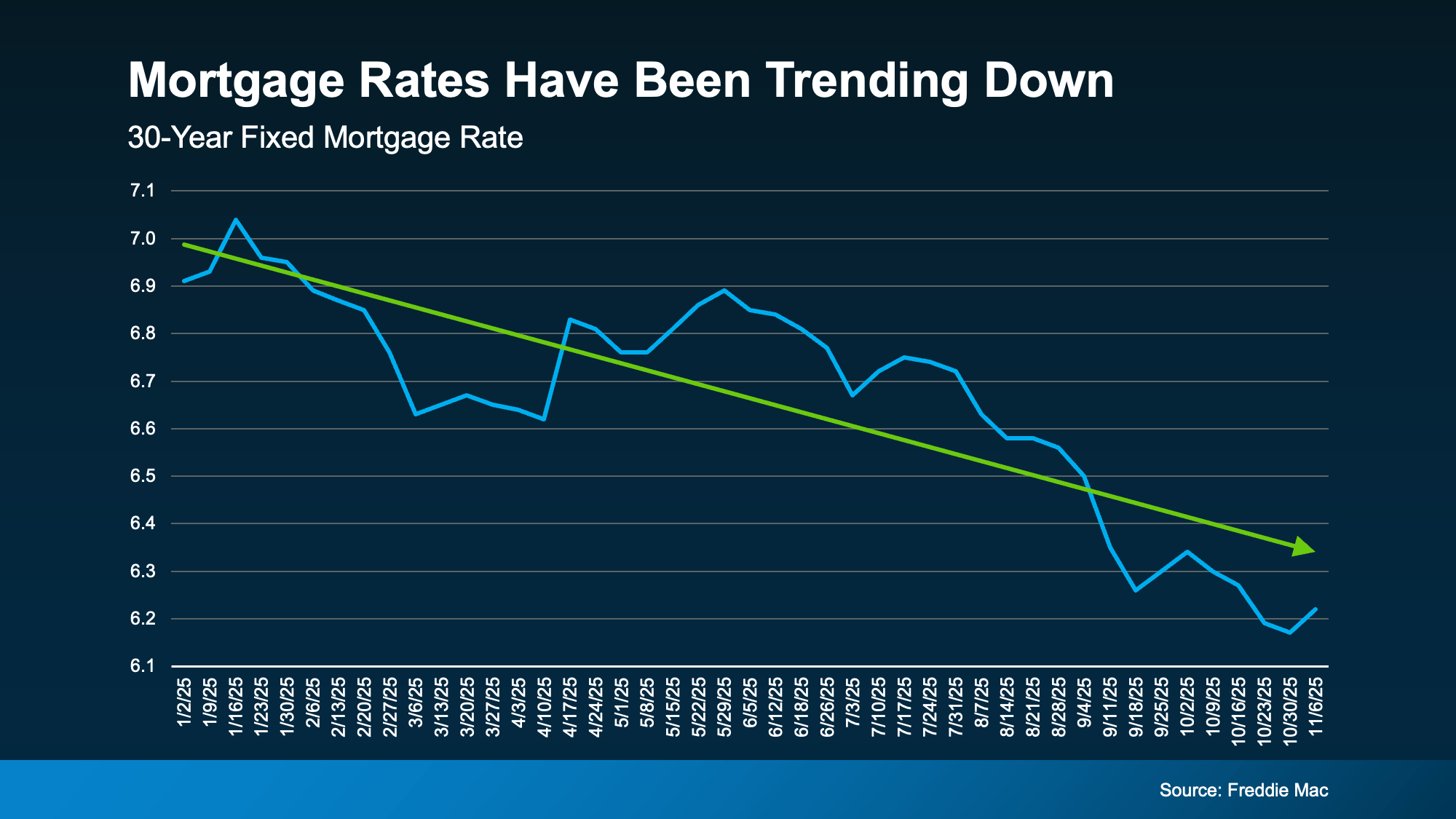

1. Mortgage Rates Have Been Coming Down

Mortgage rates fluctuate — that’s normal, especially during economic uncertainty. But the big picture matters more than the week-to-week swings. And the overall trend has been downward for most of 2025.

According to Sam Khater, Chief Economist at Freddie Mac:

“On a median-priced home, this could allow a homebuyer to save thousands annually compared to earlier this year, showing that affordability is slowly improving.”

That improvement translates directly to buying power. Redfin reports a Tampa Bay buyer with a $3,000 monthly budget can now afford roughly $25,000 more home than one year ago. That alone is bringing many buyers back into the market.

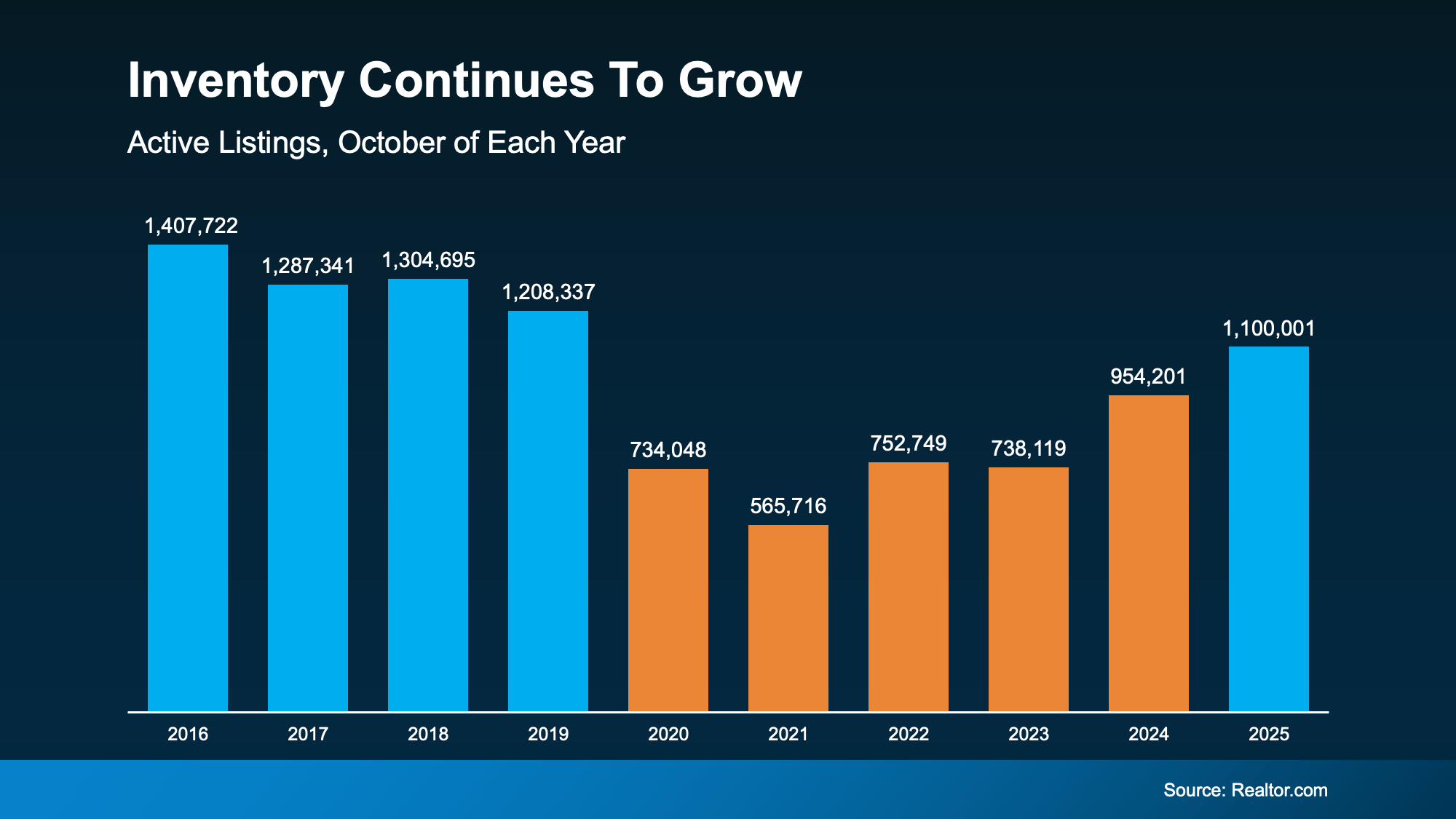

2. More Homeowners Are Ready To Sell

For years, low mortgage rates kept homeowners “locked in” — unwilling to trade a 3% rate for a higher one. But as rates ease, life events are becoming stronger motivators again: growing families, downsizing, relocations, and upgrading to neighborhoods like Carrollwood, Westchase, Citrus Park, and South Tampa.

Realtor.com data shows inventory growth accelerating — approaching levels not seen in six years.

More listings mean more choices for buyers — something the Tampa Bay market has desperately needed for years.

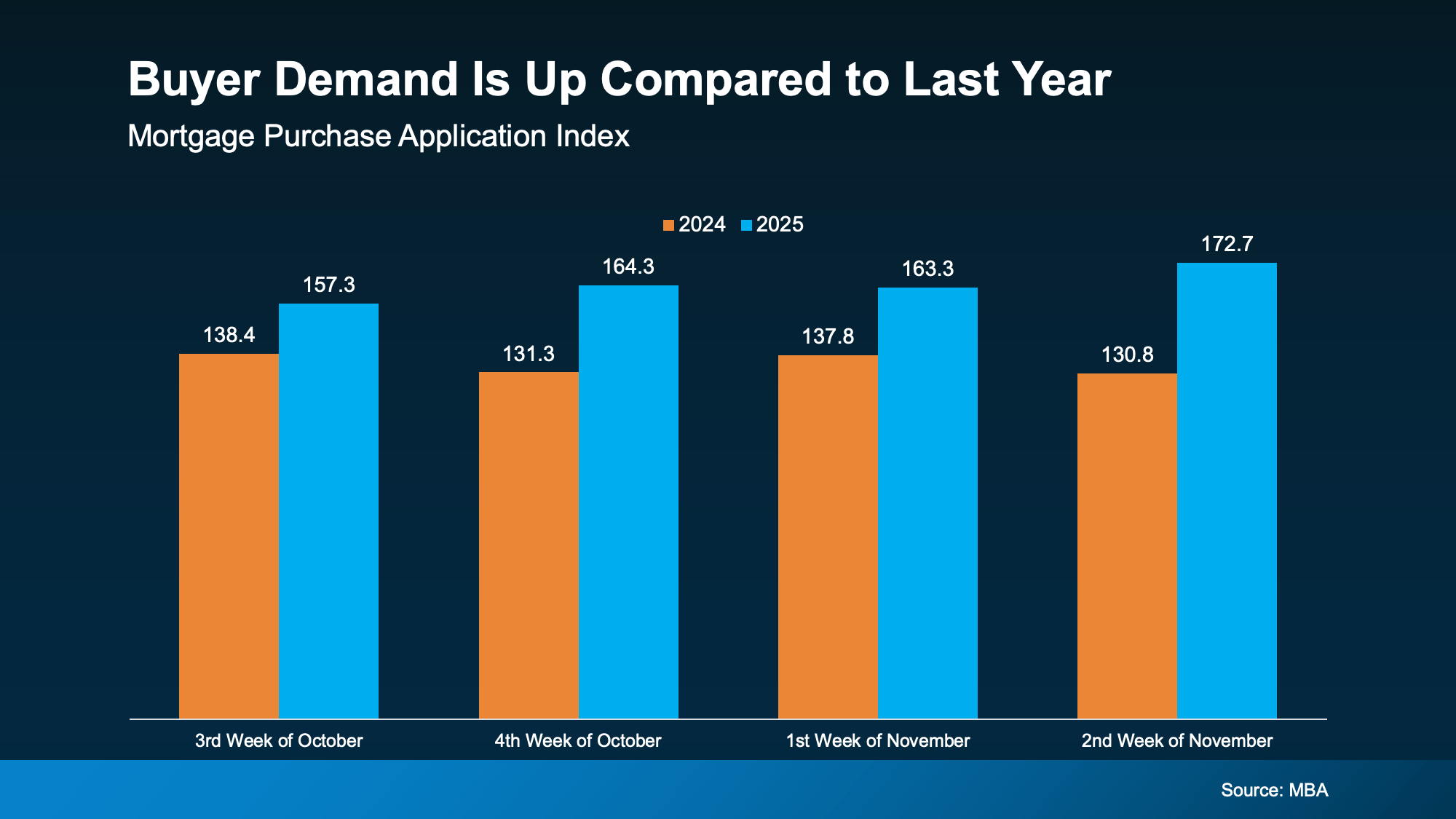

3. More Buyers Are Re-Entering the Market

With improving affordability and more homes to choose from, buyers are stepping back in. The MBA reports purchase applications are up compared to last year — a clear sign of growing demand heading into 2026.

Economists from Fannie Mae, the MBA, and the National Association of Realtors (NAR) all forecast moderate sales growth in 2026 as momentum builds.

What This Means for Tampa Bay Buyers and Sellers

While the recovery won’t be overnight, Tampa Bay is finally seeing the steady improvements many have been waiting for:

- Lower mortgage rates

- More inventory in Carrollwood, Citrus Park, Westchase, and South Tampa

- Growing buyer demand

- Better affordability for many price ranges

Bottom Line

After a slower market the past few years, the Tampa Bay housing market is finally turning a corner. Declining mortgage rates, more listings, and strengthening demand are shaping a more active year ahead.

Let’s connect and talk about what this shift means for your home purchase or sale in 2026.

Related Tampa Bay Market Updates

Categories

- All Blogs (29)

- Builder Incentives (1)

- Buyer Advice (4)

- First-Time Homebuyers (5)

- Florida Real Estate (1)

- Hillsborough County Real Estate (8)

- Home Buying & Selling Tips (16)

- Home Buying Tips (3)

- Housing Prices & Market Updates (14)

- Local Communities (1)

- Local Market Insights (14)

- Market Forecasts & Predictions (12)

- Market Trends (13)

- Mortgage & Financing (11)

- Move-In-Ready Homes (1)

- New Construction (1)

- Real Estate Market Trends (6)

- Seller Advice (2)

- Tampa Real Estate (12)

- Tampa Real Estate Market (5)

Recent Posts

Realtor® / Civil Engineer | License ID: FL# 3626016 CA# 02201474

+1(813) 729-2053 | soukaina.aroui@exprealty.com