VA Home Loan Benefits for Tampa Bay Veterans

The VA Home Loan Advantage for Tampa Bay Veterans: What You Should Know Right Now

If you’ve served (or your spouse has), you may qualify to buy a home with $0 down using a VA loan. Here’s what Tampa Bay Veterans need to know—plus how to get started with a local, military-friendly team.

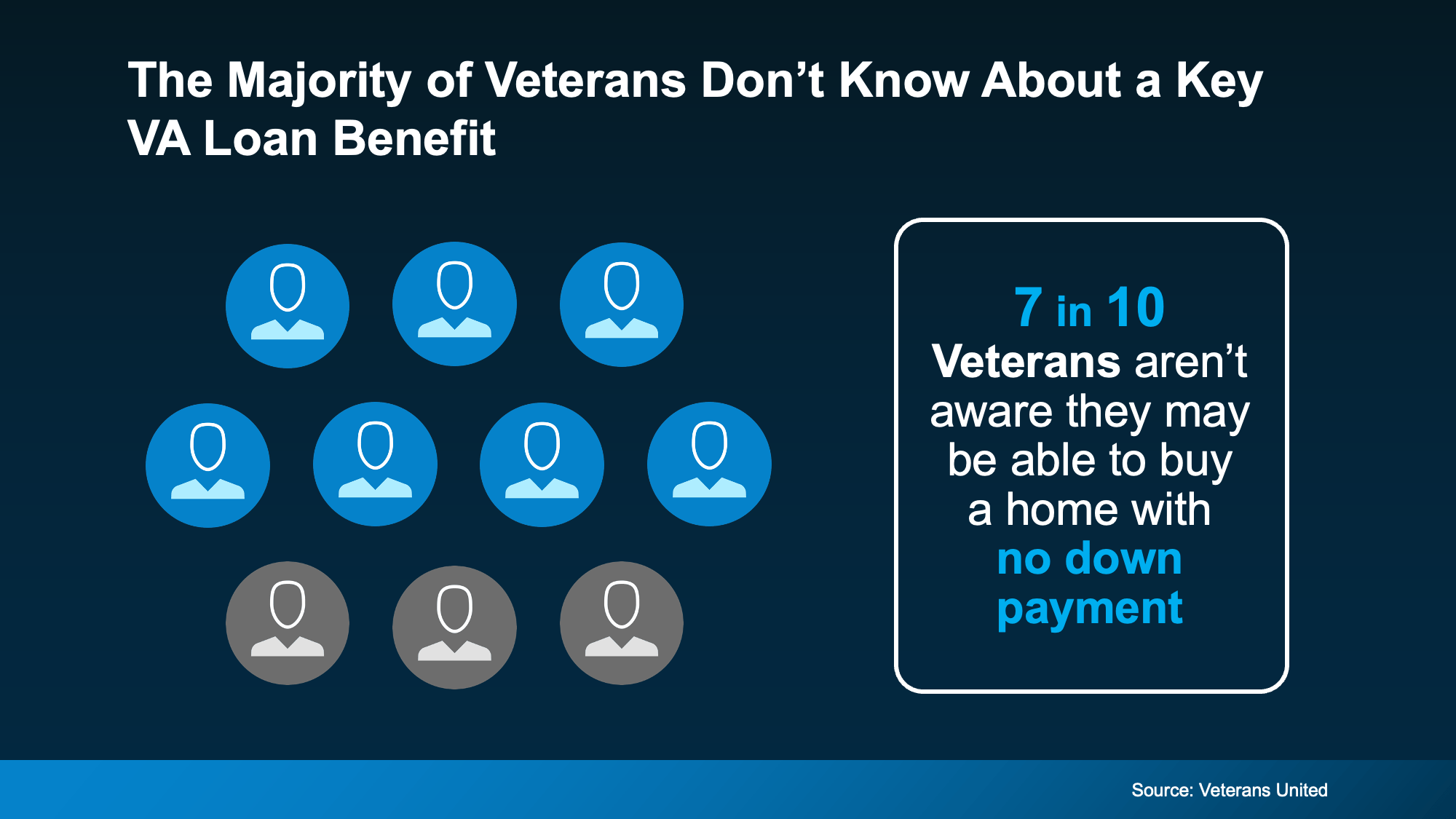

If you’ve served in the military (or if your spouse has), you have access to one of the most powerful homebuying tools out there: the opportunity to buy with $0 down. Yet, according to Veterans United, about 70% of Veterans don’t know about this benefit.

Let’s quickly break down what you really need to know about Veterans Affairs (VA) home loans—and how to make the most of them in Tampa Bay.

Why VA Home Loans Can Be a Great Option

For nearly 80 years, VA loans have helped millions of Veterans and active-duty service members become homeowners. According to the Department of Veterans Affairs, top benefits include:

- $0 Down Payment Options: Many eligible buyers can purchase without years of saving.

- Fewer Upfront Costs: The VA limits which closing costs a Veteran can be required to pay.

- No Private Mortgage Insurance (PMI): VA loans don’t require PMI, which helps lower monthly payments.

Bottom line: VA loans can boost affordability, build stability, and help you start growing long-term wealth through homeownership.

Are VA Loans Still Available During a Government Shutdown?

There’s been confusion about whether VA loans keep moving during a shutdown. While some steps may take longer, lenders can still order appraisals, obtain Certificates of Eligibility, and submit VA funding fees—so Veterans can still use their benefit. In short, the process is ready when you are (just plan for potential delays).

Why the Right Agent and Lender Matter

Using a VA home loan is smoother with a team that understands the process. A military-friendly agent and experienced VA lender will help you:

- Confirm eligibility and benefit entitlement

- Structure a strong VA offer and negotiate VA-friendly terms

- Coordinate VA appraisal and any required repairs

- Keep communication tight from contract to closing

Quick VA FAQs (Tampa Bay)

- Can I buy with no money down?

- Yes. Many eligible Veterans and active-duty buyers can purchase with $0 down using a VA loan.

- Will I pay PMI on a VA loan?

- No. VA loans do not require private mortgage insurance, which helps keep monthly payments lower.

- Can I use a VA loan for a home in Carrollwood, Citrus Park, Westchase, or South Tampa?

- Yes. VA loans can be used throughout Tampa Bay, including Carrollwood, Citrus Park, Westchase, and South Tampa.

- Do I need a special agent for a VA loan?

- You don’t need a special license, but it helps to work with a military-friendly agent experienced in VA transactions.

Bottom Line

If you’re a Veteran, a VA home loan is one of the most valuable benefits you’ve earned. With options for $0 down, limited closing costs, and no PMI, VA loans can make homeownership more attainable in Tampa Bay.

If you’re in Carrollwood, Citrus Park, Westchase, South Tampa, or anywhere in Hillsborough County, let’s connect to explore your eligibility and start your VA home search with confidence.

Explore Tampa Bay Neighborhoods

Related Guides

Categories

- All Blogs (29)

- Builder Incentives (1)

- Buyer Advice (4)

- First-Time Homebuyers (5)

- Florida Real Estate (1)

- Hillsborough County Real Estate (8)

- Home Buying & Selling Tips (16)

- Home Buying Tips (3)

- Housing Prices & Market Updates (14)

- Local Communities (1)

- Local Market Insights (14)

- Market Forecasts & Predictions (12)

- Market Trends (13)

- Mortgage & Financing (11)

- Move-In-Ready Homes (1)

- New Construction (1)

- Real Estate Market Trends (6)

- Seller Advice (2)

- Tampa Real Estate (12)

- Tampa Real Estate Market (5)

Recent Posts

Realtor® / Civil Engineer | License ID: FL# 3626016 CA# 02201474

+1(813) 729-2053 | soukaina.aroui@exprealty.com