Tampa Home Equity: Do You Know How Much Your House Is Worth?

Do You Know How Much Your House Is Really Worth?

Most homeowners don’t check the value of their house as often as they should—but your home is likely your biggest financial asset. If you’ve lived in one of Tampa’s vibrant neighbourhoods—Carrollwood & Citrus Park, Westchase & South Tampa, Davis Islands or Downtown Tampa—for several years, it has probably been quietly building wealth for you in the background.

You might be surprised by just how much equity you’ve gained, even as the market has shifted over the past few months.

What Is Home Equity?

Home equity is the difference between what your house is worth today and what you still owe on your mortgage. It grows over time as home values rise and as you pay down your loan.

For example, if your house is now worth $500,000 and you still owe $200,000, you have $300,000 in equity. In fact, Cotality reports the average U.S. homeowner with a mortgage has about $302,000 in equity:contentReference[oaicite:0]{index=0}.

Why You Probably Have More Than You Think

Two key factors explain why so many homeowners have near‑record amounts of equity right now:

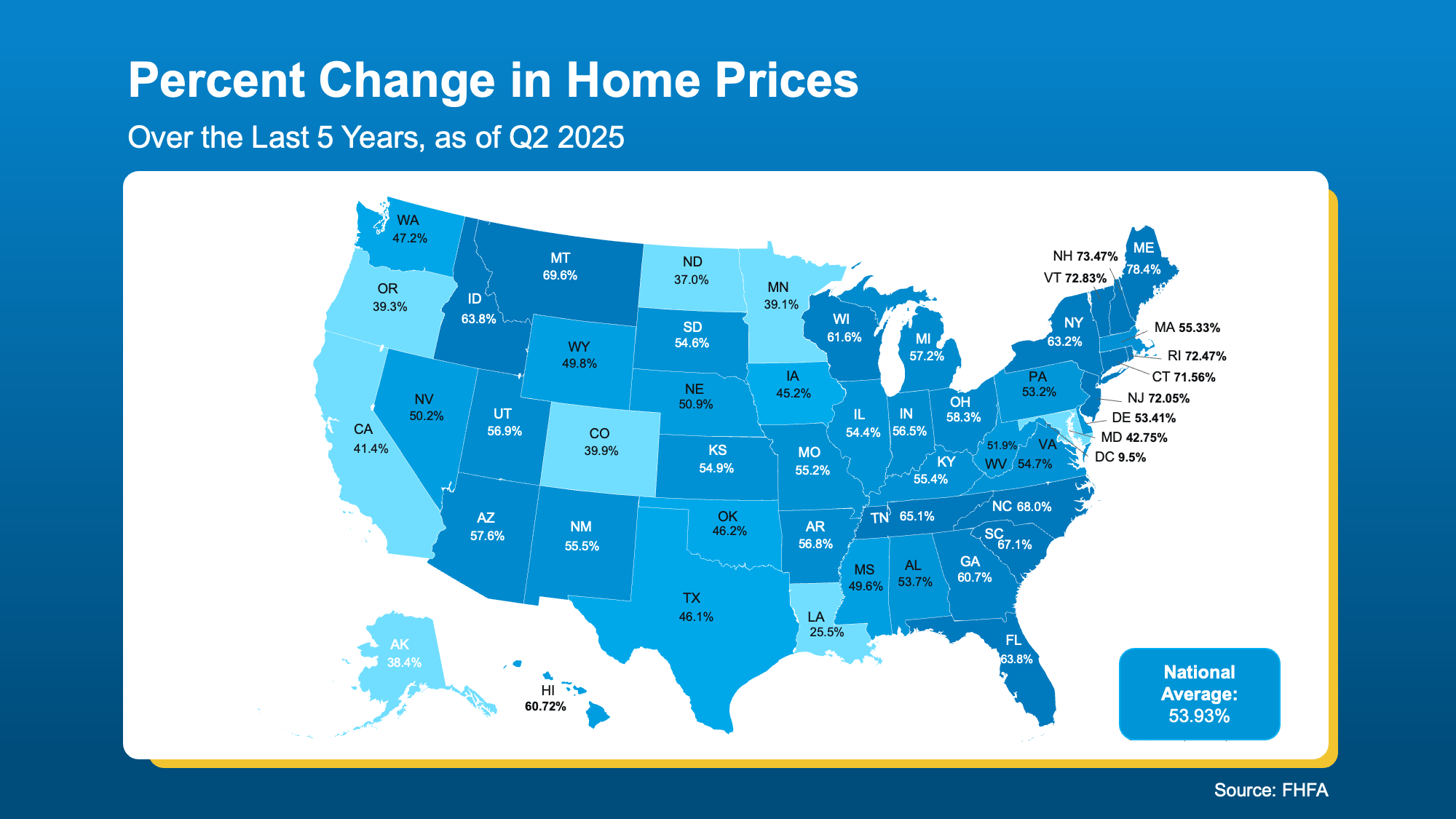

1. Significant home price growth. According to the Federal Housing Finance Agency, home prices nationwide have jumped nearly 54% over the last five years:contentReference[oaicite:1]{index=1}:

This means your house is likely worth much more now than when you bought it. If you’ve been in your home for a few years or more, you probably have enough equity to sell and still come out ahead.

This means your house is likely worth much more now than when you bought it. If you’ve been in your home for a few years or more, you probably have enough equity to sell and still come out ahead.

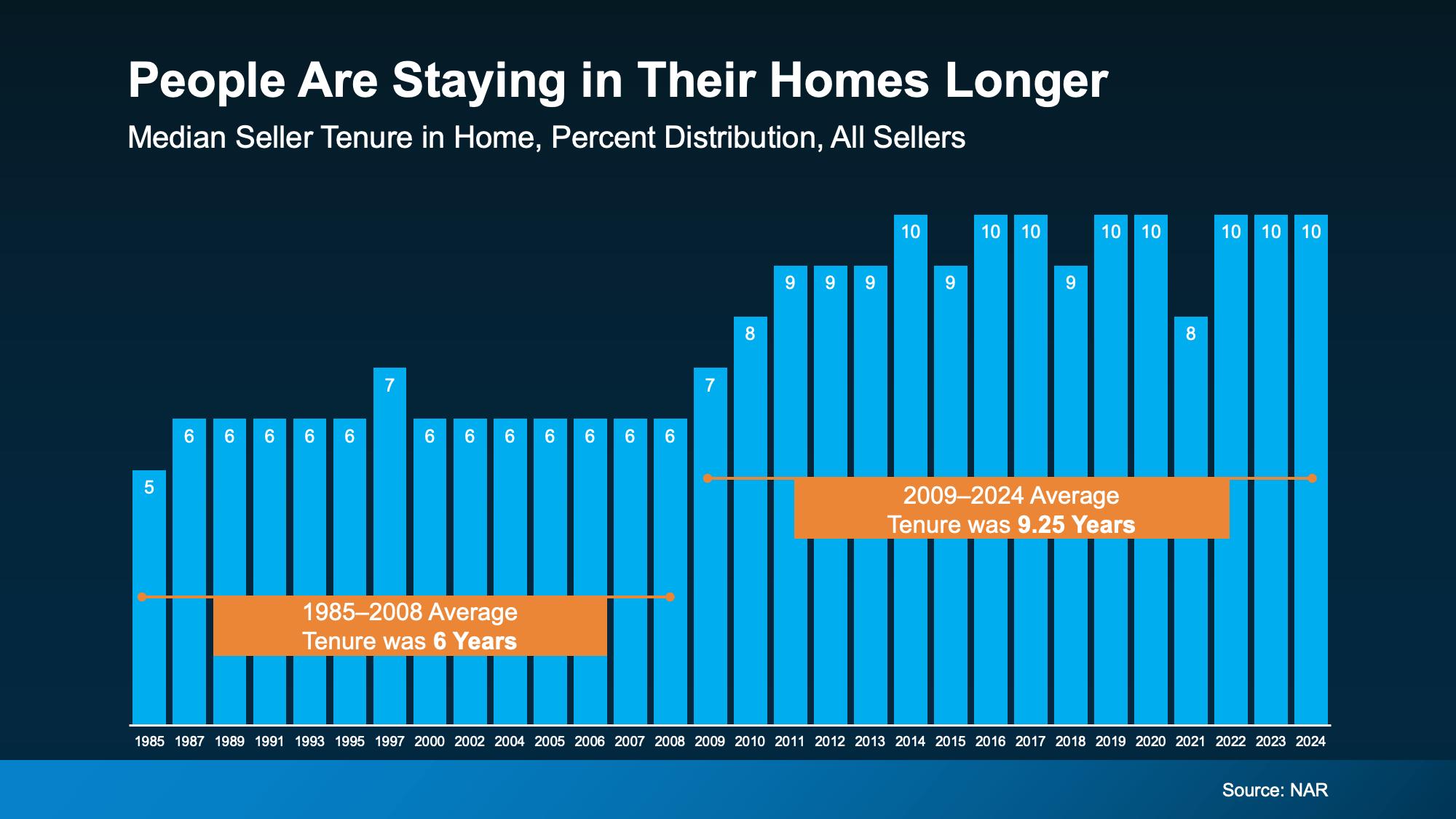

2. Homeowners are staying put longer. Data from the National Association of Realtors shows the typical homeowner stays in their home about 10 years:

Over that decade, you’ve built equity by making your mortgage payments and benefiting from rising property values. Homeownership is a long game—and over time, that means you’re winning.

Over that decade, you’ve built equity by making your mortgage payments and benefiting from rising property values. Homeownership is a long game—and over time, that means you’re winning.

According to NAR, over the past decade the typical homeowner has accumulated $201,600 in wealth solely from price appreciation.

What Could You Do With That Equity?

Equity isn’t just a number on paper—it’s a powerful tool. You could:

- Use it to buy your next home. Equity can help cover the down payment on your next property—sometimes enough to buy outright.

- Renovate your current house. Strategic improvements can enhance your lifestyle now and boost your resale value later.

- Invest in your future. Your equity could fund a business, cover education or support other investments.

Bottom Line

If you’ve been in your home for a while, you may have built more wealth than you realise. Many homeowners in Tampa’s core communities are sitting on sizeable equity right now.

Discover your home’s value with our free evaluation tool—it only takes a minute to see an estimated market value and how much equity you may have.

Prefer a personalised consultation? Contact us to discuss your options and get a detailed equity assessment.

Categories

- All Blogs (29)

- Builder Incentives (1)

- Buyer Advice (4)

- First-Time Homebuyers (5)

- Florida Real Estate (1)

- Hillsborough County Real Estate (8)

- Home Buying & Selling Tips (16)

- Home Buying Tips (3)

- Housing Prices & Market Updates (14)

- Local Communities (1)

- Local Market Insights (14)

- Market Forecasts & Predictions (12)

- Market Trends (13)

- Mortgage & Financing (11)

- Move-In-Ready Homes (1)

- New Construction (1)

- Real Estate Market Trends (6)

- Seller Advice (2)

- Tampa Real Estate (12)

- Tampa Real Estate Market (5)

Recent Posts

Realtor® / Civil Engineer | License ID: FL# 3626016 CA# 02201474

+1(813) 729-2053 | soukaina.aroui@exprealty.com