Closing Costs in Tampa Bay: What Today’s Buyers Need to Know

Closing Costs in Tampa Bay: What Today’s Buyers Need to Know

If you’re planning to buy a home this year in Tampa Bay — whether in Carrollwood, Citrus Park, Westchase, or South Tampa — there’s one expense you can’t afford to overlook: closing costs.

What Are Closing Costs?

Your closing costs are the additional fees and payments you make when finalizing your home purchase. Every buyer has them. According to Freddie Mac, they typically include things like homeowner insurance and title insurance, as well as various fees for your:

- Loan application

- Credit report

- Loan origination

- Home appraisal

- Home inspection

- Property survey

- Attorney

National vs. Local: Why Numbers Look Different

When you search online, you’ll often see a national range of 2% to 5% of the purchase price. While that’s a useful starting point, it doesn’t tell the whole story. In reality, your closing costs will also vary based on:

- Taxes and fees where you live (like transfer taxes and recording fees)

- Service costs for things like title and attorney work in your local area

State laws, tax rates, and local service costs all impact your final number. That’s why it’s important to talk to your lender and a local real estate agent before you start shopping. It can put you in control before you even make an offer.

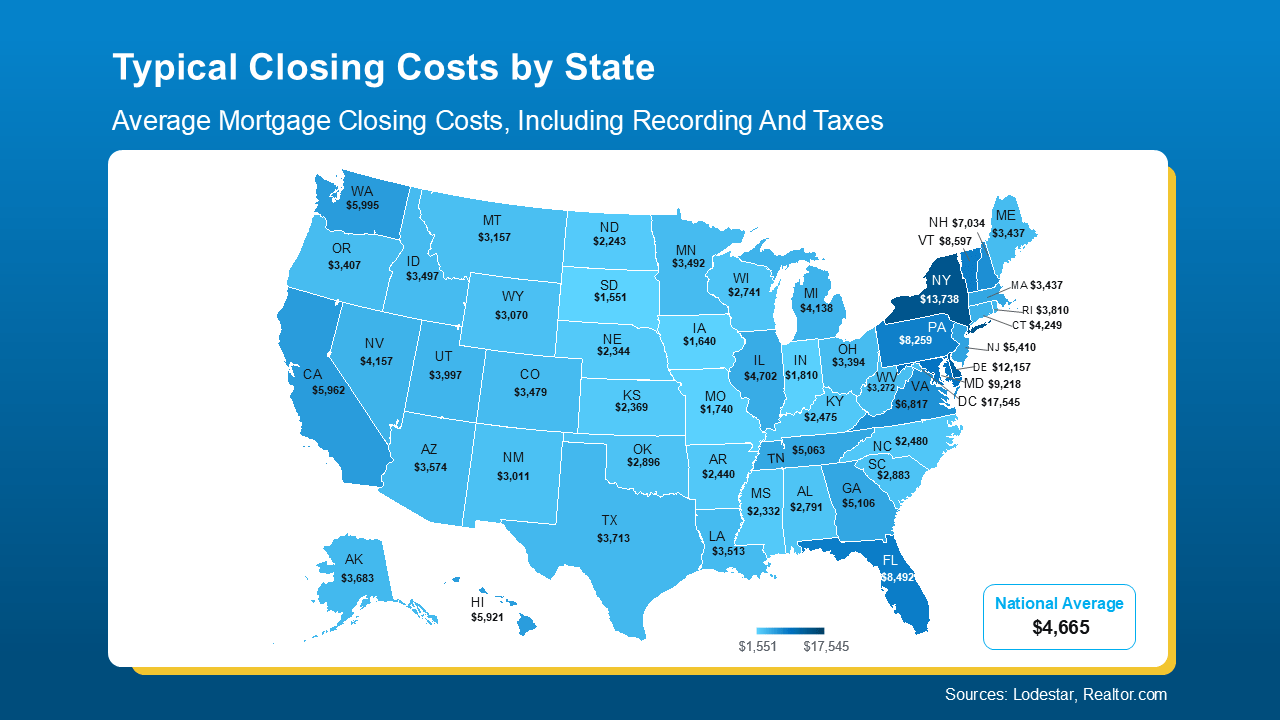

To give you a ballpark, here’s a state-by-state report of typical closing costs right now (see map below):

As the map shows, some states see closing costs of just $1K–$3K, while others range $10K–$15K. That’s a huge difference, especially for first-time buyers.

Ways to Reduce Closing Costs

Wondering if there’s any way to trim your bill? NerdWallet shares a few strategies that can help:

- Negotiate with the seller. Ask for concessions like a credit toward your closing costs.

- Shop around for homeowner’s insurance. Compare coverage and rates before you commit.

- Check for assistance programs. Some states, professions, and neighborhoods offer help. Your agent and lender can point you to local options.

Bottom Line

Closing costs are a key part of buying a home, but they vary more than most people realize. Knowing your numbers (and how to potentially bring them down) can help you feel confident about your purchase.

Let’s review what typical closing costs look like here in Tampa Bay and create a personalized estimate, so you can craft your ideal budget. Schedule a consultation today or get your free home value report.

Categories

- All Blogs (29)

- Builder Incentives (1)

- Buyer Advice (4)

- First-Time Homebuyers (5)

- Florida Real Estate (1)

- Hillsborough County Real Estate (8)

- Home Buying & Selling Tips (16)

- Home Buying Tips (3)

- Housing Prices & Market Updates (14)

- Local Communities (1)

- Local Market Insights (14)

- Market Forecasts & Predictions (12)

- Market Trends (13)

- Mortgage & Financing (11)

- Move-In-Ready Homes (1)

- New Construction (1)

- Real Estate Market Trends (6)

- Seller Advice (2)

- Tampa Real Estate (12)

- Tampa Real Estate Market (5)

Recent Posts

Realtor® / Civil Engineer | License ID: FL# 3626016 CA# 02201474

+1(813) 729-2053 | soukaina.aroui@exprealty.com